Small-caps have staged an impressive rally over the past couple of weeks. Since trade tensions softened and Treasury yields soared, small-caps have smacked around large-caps returning 6.5% compared to just a 2% return for the S&P 500. It's been quite a turnaround compared to what we've seen during most of 2019.

There's reason to think that this outperformance might continue too. The Fed's anticipated plan of cutting rates aggressively over the next 12 months combined with a U.S. economy that's still performing pretty well despite hints of a slowdown has equity bulls feeling like the growth potential and relative value of small-caps could be a good landing spot. The Russell 2000 is about 20% cheaper than the S&P 500 right now according to price/earnings measures.

In my opinion, small-cap dividend payers are the better bet. We've already seen a sentiment shift away from the long-outperforming growth and momentum names over to value and cyclical stocks. Small-cap dividend stocks also offer a bit of a downside cushion in case economic data comes in worse than expected and market sentiment turns bearish quickly. The combination of value, yield and long-term growth potential is a good mix for this market.

Since high yielders have begun outperforming dividend growers again, I've got the ETRACS Monthly Pay 2x Leveraged U.S. Small Cap High Dividend ETN Series B (SMHB) on my radar. It aims to deliver twice the performance of the Solactive U.S. Small Cap High Dividend Index, which measures roughly 100 companies with the highest expected dividend yield over the following 12 months.

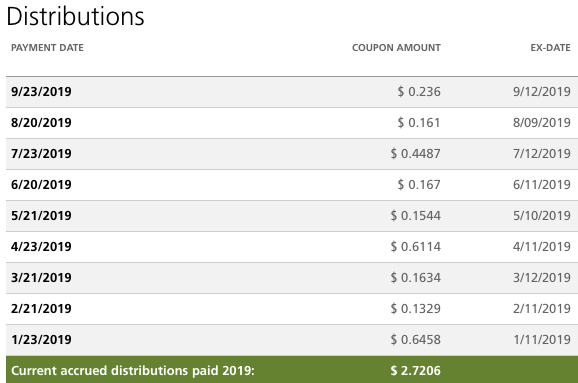

For income seekers, SMHB is nice because it pays twice the yield of its underlying index, pays on a monthly basis and offers an annualized yield of nearly 20%.

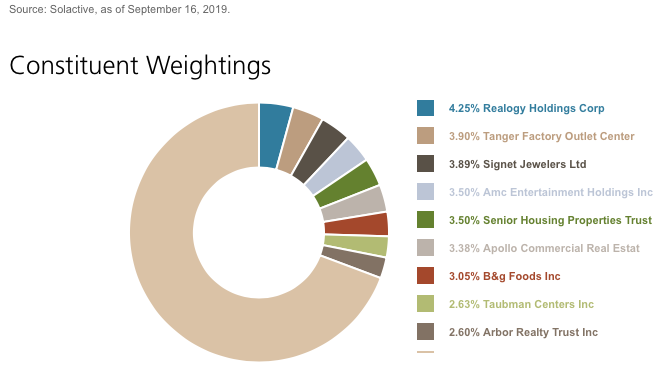

As you might expect, this ETN is loaded with high-yielding REITs. That's great for yield but can mean outsized exposure to the real estate market.

In the current environment, if the U.S. and China come to some type of trade agreement, that likely means good things for growth and cyclical sectors but less so for defensive sectors. That also means that small-caps should be expected to do well as investors feel more comfortable adding risk to their portfolios. If you have a long-term timeframe in mind, small-caps are at an intriguing entry point and while the risk involved with a leveraged product can be substantial the returns and yields can make it worthwhile.

While dividends are paid on a monthly basis, the largest share of the annual dividend comes quarterly. That erratic distribution history could present a bit of a problem for those living off of their portfolio.

While SMHB is certainly risky as any leveraged small-cap fund would be, this is a better market to be targeting long-term than overpriced large-caps. The road for REITs may be bumpy in the short-term but long-term shareholders willing to ride out some of the risk involved will likely be well-rewarded.