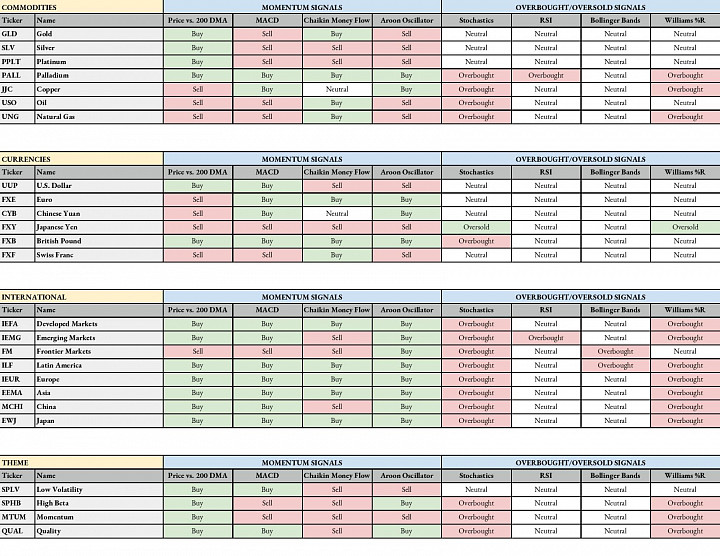

Market momentum is beginning to shift away from U.S. equities and towards international equities. Emerging markets, in particular, are looking attractive as the falling dollar has fueled gains. Developed markets aren't looking quite as strong but I expect a long overdue period of outperformance could be in store as long as the dollar remains depressed and foreign central banks stand ready to continue pumping liquidity into their economies. A new tone of optimism on the trade front also adds to the relative bullishness of equities.

Fixed income is heading in the other direction. Most short-term indicators point to weakness as the 25 basis point rise in the 10-year Treasury yield reflects the broader risk-on environment of the markets. Junk bonds continue to perform well. Investment-grade corporates have outperformed Treasuries thanks to shrinking spreads and optimism over credit quality. This will be a key week for the fixed income markets as the double whammy of the quarterly Fed meeting and the release of the preliminary Q3 GDP reading could really add to volatility.

Precious metals indicators are mostly mixed to bearish. Gold has hung tightly to the $1500 level for a couple months as it balances the risks of global recession with the possibility of a Fed-fueled economic expansion. For my money, precious metals are looking poised to rally here with the chances of gold making a run at $1700 looking more likely. Silver is also looking attractive and could ultimately be ready to outperform gold if investors get skittish.

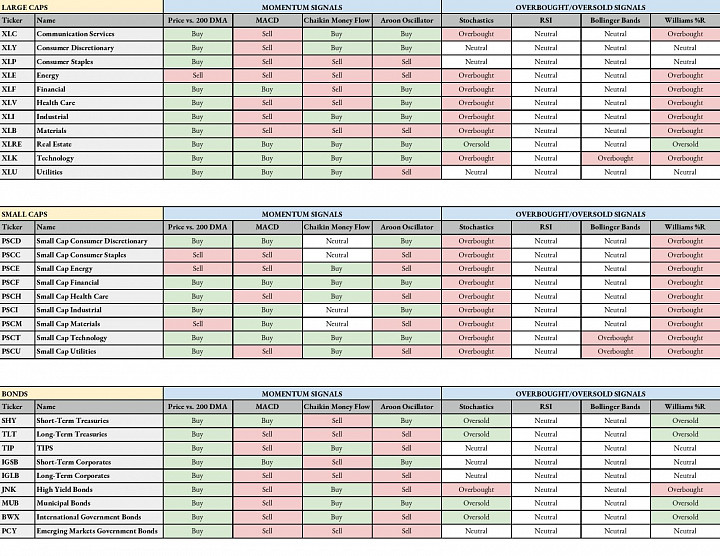

Here is the full scorecard for the week ahead.