In the old days of investing, you needed to work through a broker who charged you a commission every time you made a trade. Then, the mutual fund came along and allowed you to buy an entire managed basket of securities all in one trade for a modest annual fee. The mutual fund was largely replaced by the ETF which, in many cases, eschewed the traditional active manager in favor of simply tracking an passive index and doing it for a fraction of the cost.

Now, we may be at the start of the next stage of investment management: artificial intelligence.

AI-Powered ETFs

I want to take a look at the AI Powered Equity ETF (AIEQ). It's a fund that turns the entire portfolio construction process over to Watson-powered artificial intelligence and takes the human element out of investment management entirely.

The fund applies proprietary analytical algorithms to artificial intelligence (AI) technology, which can process over one million pieces of information per day, to build predictive financial models on approximately 6,000 U.S. companies. The technology continually analyzes data and models in its active stock selection process, and derives an optimal risk adjusted portfolio consisting of companies with high opportunities for capital appreciation. The fund is actively-managed and discloses all portfolio holdings daily.

In theory, this strategy makes sense. After all, there are loads of studies confirming how people make emotional and irrational decisions with their portfolios. If you could take a fully objective approach, why not?

The Performance Lag

The answer is that so far there's not much proof that it helps.

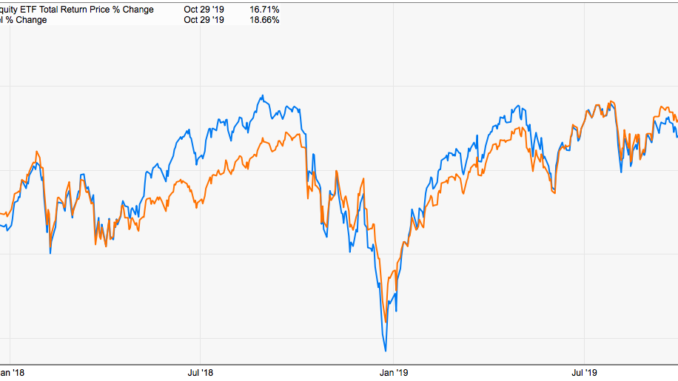

AIEQ got off to a great start following its late-2017 launch. Once the Q4 correction hit, however, it really underperformed. It again got off to a solid start in 2019 but it's since gone sideways over the past six months.

It's Not Really Any Different Than Owning The S&P 500

The more curious aspect of AIEQ for me is its relationship to the performance of the S&P 500. In other words, it's almost identical.

The correlation factor to the S&P 500 is 0.97. AIEQ has essentially been a closest index fund over most of its life. I'd really hoped that AIEQ would be more of an outside-the-box portfolio that would add a diversification element when paired with the S&P 500 but so far that hasn't been the case.

It's Way Too Expensive

Unfortunately for investors, all that computer power costs money to operate. AIEQ comes with an expense ratio of 0.77%. Compare that to owning an S&P 500 ETF that costs you just 3 or 4 basis points. AIEQ needs to outperform the benchmark by more than 70 basis points every year in order to justify the cost. That's a high bar for almost any manager to clear.

How To Use This In Your Portfolio

You probably don't want to. At least at this early junction. There's not a lot of research that's been done into the efficacy of AI-powered management strategies but the early evidence is weak. You could allocate a small portion of your portfolio (no more than 5%) to AIEQ as a potential growth booster but it seems unlikely that it's going to help your portfolio.

The Verdict