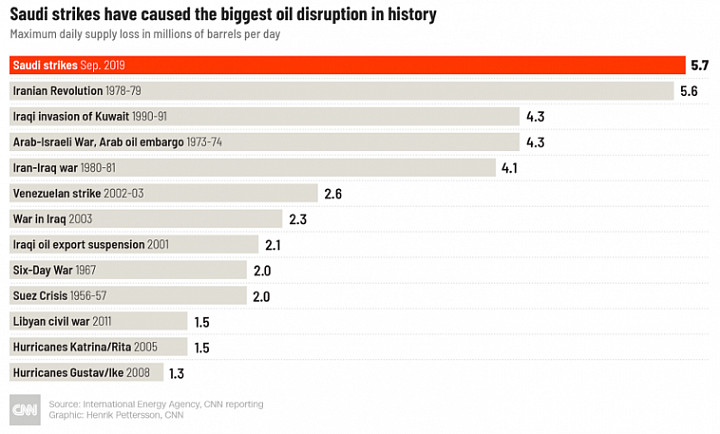

As you likely already know, Saudi Arabian oil fields were damaged in a drone attack over the weekend crippling roughly 5% of the world's daily oil output. Both WTI and Brent crude oil prices are up about 12% on the day despite President Trump releasing some of the strategic reserves. This is one of the biggest oil disruptions in history.

Oil and energy ETFs are spiking on the news despite the broader market falling today. The biggest energy ETF, the Energy Select Sector SPDR ETF (XLE), is up about 2.5% after rising more than 4% at the open.

There are two trains of thought as to where this group could go from here.

The first I'm hearing more frequently is that this is an example of how vulnerable the oil industry and its infrastructure is to attacks like this and the market has been underpricing this risk for a while. Also is the consideration that Trump has used the phrase "locked and loaded" in a recent tweet as an implied threat to Iran. I believe that nothing will come of the Trump tweet but the possibility of further strikes remains a real risk. If tensions escalate and Iran and Saudi Arabia get involved in a back-and-forth, oil prices and energy ETF prices will be heading up from here.

The second is that this is essentially a temporary interruption of service. Yes, much of the Saudi oil production is offline right now but early rumors have these oil fields being back online within a week or two. I'd presume that when this happens (or is near happening), oil prices will begin retreating again and concerns over global economic weakness and energy demand will take over again.

I believe that the latter is what's going to happen and today's spike in the energy sector is a temporary bounce that will soon come back down to earth. Therefore, I'm recommending investors avoid buying energy ETFs at the current time or consider selling existing positions.

This is a list of the largest ETFs to consider selling (but is by no means all-inclusive).

- Energy Select Sector SPDR ETF (XLE)

- Vanguard Energy ETF (VDE)

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP)

- iShares Global Energy ETF (IXC)

- iShares U.S. Energy ETF (IYE)

- VanEck Vectors Oil Services ETF (OIH)

- Fidelity MSCI Energy Index ETF (FENY)

What do you think? Are you selling energy stocks here? Comment down below!