As we head into the second half of 2019, the financial markets are telling us two stories.

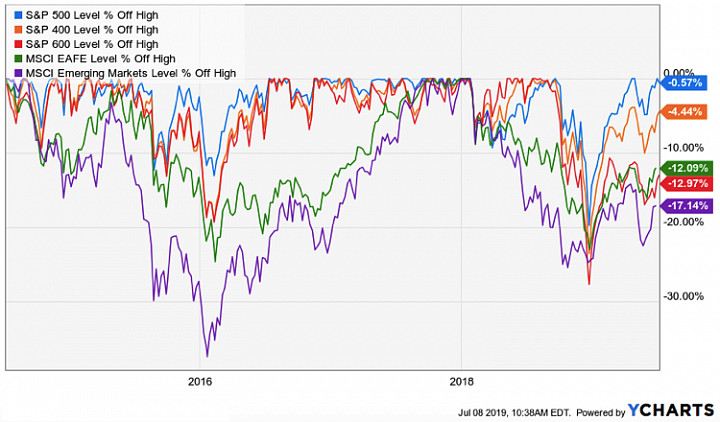

The first is the equity markets. If you pay attention to just the S&P 500, which most people do, you probably think everything is great. The index just hit a new all-time high and is up 19% year-to-date. Most other major indices are also up double-digits although the longer-term picture is a bit more bearish. International developed markets stocks and small-caps are still 13% off of their highs. Emerging markets are off by 17%.

Still, it's obvious what has been driving equity returns since the Christmas Eve lows: the Fed. Stocks have been rallying almost non-stop since the Fed went from its hawkish stance of 2-3 rate hikes in 2019 to an extremely dovish position that has the Fed Futures market forecasting an 87% chance of two or more rate hikes before the end of the year. Part of the reason for this is a steady stream of data indicating that the global economy is slowing (more on this in a minute). The Fed seems intent on getting ahead of a potential liquidity crunch that could be fueled by the deterioration of European banks and a slowing demand for personal loans and business investment. The other reason is the blunt demand by the White House for immediate rate cuts. We've seen in the past that either directly or indirectly, President Trump tends to get what he wants. In this case, he wants a lower Fed Funds rate and the FOMC seems inclined to give it to him despite a healthy GDP reading, record low unemployment and non-existent inflation. Investors are betting that a flood of cheap money into the marketplace will keep inflating asset prices beyond what may be reasonable given the recessionary risks that are growing.

The other is the bond market. Whereas the equity narrative is Fed-driven, bonds are data-driven. There has been some steepening on the long-end of the Treasury yield curve (the 30Y/10Y spread has grown from 12 basis points a year ago to 50 today), the 10Y/3M spread is back down to -0.19%. That's off of its low of -0.28% set back in early June but well into the territory that suggests a recession is imminent. The 10-year Treasury rate is back down to 2% and sovereign debt yields are negative in many countries around the world. Manufacturing and industrial production readings are dipping into contraction. The housing market grows ever weaker. Bond traders are pricing in a significant global economic slowdown and they're not optimistic.

These are two distinct narratives. The dichotomy has created the unusual existence of both strong equity and fixed income returns in the same year, the best combined performance in more than two decades. But which market will end up being right? History suggests that the bond market gets it right more often than not and I tend to agree that this will be the case here. If the equity markets stood on their own merits and weren't currently being pumped up by the Fed, I'd argue that we may already be in a bear market and headed towards recession. The Fed instead seems to now have the dual mandate of both effecting economic policy and supporting the financial markets which puts us into dangerous territory. With $4 trillion still on the Fed's balance sheet, $21 trillion in government debt and interest rates possibly heading back under 1% when all is said and done, there's precious little room for error. The Fed's desire to prop up the financial markets could be setting investors up for an even more violent pullback in prices at some point in the future.

Which market do you think is getting the narrative correct? Bonds or stocks? Feel free to comment down below!