As much as the Fed tries to use a combination of lower interest rates, fiddling with the dollar's value and the possibility of another round of QE, inflation has remained stubbornly low and it may be there to stay.

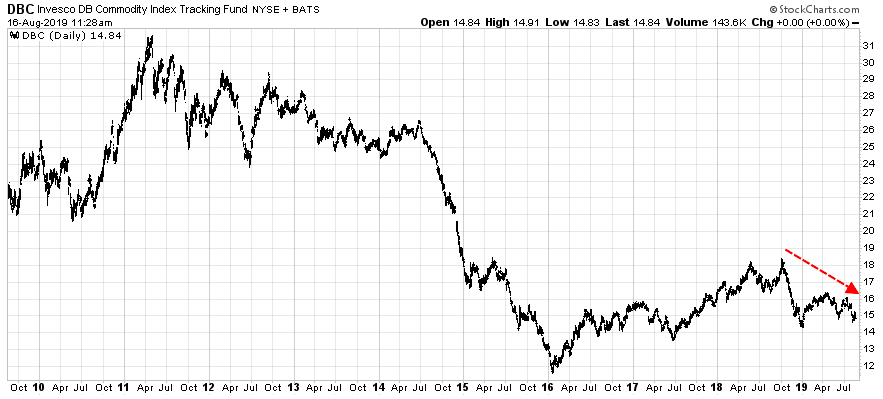

The Invesco DB Commodity Index Tracking Fund (DBC) was tracking higher for most of the three-year period from 2016-2018 but has reversed course in 2019.

This is particularly unusual because commodity prices typically rise as we head into recessionary environments. This could be because the Fed typically lowers rates in order to stoke inflation and encourage spending which in turn increases the demand for basic products like grains and meats and fuels.

This time around though they're falling. And that's despite the fact that the yield curve has mostly inverted which typically is a signal that a recession is imminent. How should we interpret this? I have two different thoughts.

- Traders don't believe that a recession is as close as some would think

- Traders don't believe that cutting interest rates will work in igniting inflation.

To the first point, I think there might be some merit. The economy is still at full employment, annualized GDP growth is still at around 2% and inflation is still below Fed targets. We already know that a sustained rate cutting cycle has never begun when we have this type of economic data. Recessionary risks are undoubtedly growing as we've seen almost everywhere worldwide if not necessarily here in the United States. But several popular economic indicators need to turn around meaningfully before we can say with confidence that we're in a recession.

To the second point, I believe this is the more likely reason. Despite what we hear from Washington, the ongoing trade war is affecting economies both here and around the world. Tariffs mostly result in higher prices for consumers and companies are starting to feel it on their bottom lines. Corporate bond default rates are mostly in check still in the U.S. but they're starting to spike in places like China that are heavily impacted by the trade war. The easiest solution to averting a global slowdown at this point is easy: end the trade war. Both sides, however, have dug in and refuse to give the impression that they're not winning so we might be in for the long haul. The Fed can lower interest rates but it likely won't have the intended impact if everyone is levying tariffs on imports.

We're in a bit of uncharted territory here but it doesn't appear that price inflation is anywhere in our future despite what the Fed tries to do if the commodities market is to be believed. At this point, it's looking more like a longer period of economic stagnation.