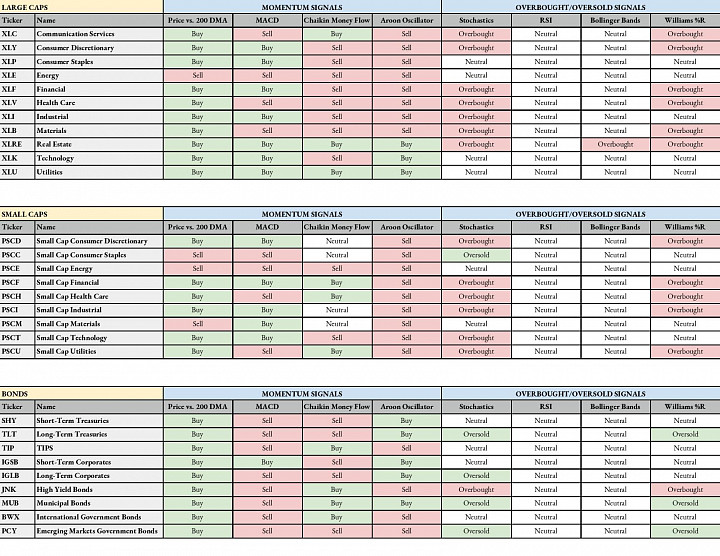

While most equity sectors, both large-cap and small-cap, remain above their 200-day moving averages, most of the other indicators are flashing sell signals. Small-caps have outperformed over the past month with many of the cyclical and trade-sensitive sectors leading the way. Trade optimism is perhaps the biggest factor leading stocks higher but a Brexit near-resolution, electronic money printing and tame inflation have all been contributing to the recent rally.

Fixed income, on the other hand, is turning negative again. The 10-year Treasury yield has jumped nearly a quarter-point in just the past couple of weeks sending long-dated Treasuries to losses of 4-6% on short order. Junk bonds, however, have jumped on the heels of the equity rally. Spreads on debt rated BB and below have shrunk to within a stone's throw of their 2019 lows as investors feel more confident that government stimulus and low rates will help them steer clear of an economic recession and the rise of default rates that could come with it.

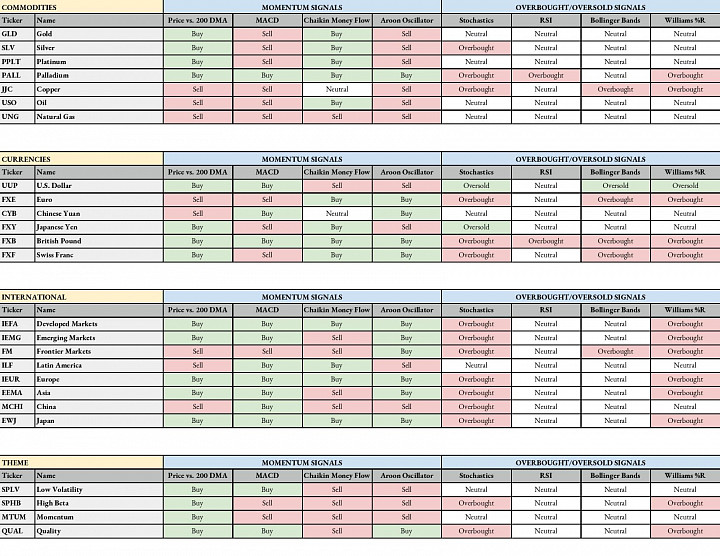

After rising throughout most of the summer, gold has been range-bound for two solid months now hovering around the $1500 level. Much of the news that has come lately has been at least modestly positive but the fact that gold didn't break down on that news could be viewed as a bullish sign for its longer-term prospects. The dollar is experiencing its first notable decline since it was falling steadily for most of 2017. I've argued that emerging markets remain a relatively attractive option despite global economic pressures and a declining dollar could finally be the catalyst that pushes the group to outperform.

Here is the full scorecard for the week ahead.