Getting added to one of the major MSCI indices can mean big flows into stocks and ETFs that cover these areas. When a country gets added to an index, funds that track that index must add the country's equities to their portfolios in order to continue properly tracking the index. That can mean a lot of buying activity and boost in prices that can be taken advantage of by savvy investors.

The latest country in focus is Saudi Arabia. MSCI will be adding the country to its emerging markets index in waves throughout 2019. The first batch was added in March with further additions planned in May and August.

When all is said and done, Saudi Arabia will account for approximately 3% of the MSCI Emerging Markets Index. That may not sound like a lot but keep in mind that the two largest emerging markets ETFs - the iShares MSCI Emerging Markets ETF (EEM) and the iShares Core MSCI Emerging Markets ETF (IEMG) have almost $100 billion in assets combined between the pair. By the end, MSCI will add approximately $84 billion in Saudi Arabian equities, about 15% of its total stock market capitalization.

It's tough to say exactly what kind of bounce could be expected since there are so many factors that go into play. The most recent addition to the MSCI indices was China A-Shares. Those occurred throughout 2018 in a year when Chinese equities lost nearly 20% of their value. In 2019, not only have China stocks rebounded strongly gaining about 20%, China A-Shares have led the way with a 32% gain.

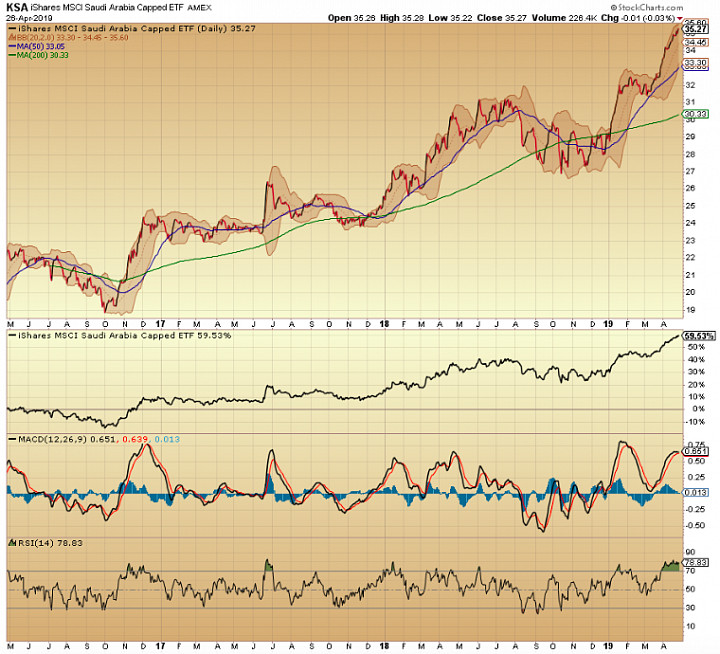

What's clear though is that this guaranteed heavy buying activity that will take place over the next several months can only help the country's equity return prospects. The best way to play it is the iShares MSCI Saudi Arabia Capped ETF (KSA). A lower cost but less liquid option is the Franklin FTSE Saudi Arabia ETF (FLSA). Both funds are up 22% year-to-date.

What do you think? Will you take a swing at Saudi Arabia stocks? Comment down below!