Quite often, I get questions from readers asking about funds and ETFs whether it's in the comment thread of an article or as a direct message. So I thought it might be useful to take these questions along with my answers and put it up as a quick post. I figure there are a lot of cases where someone has a similar question so why not use it as a learning opportunity for everybody?

As always, all names have been removed for anonymity. Do you have a question you're looking to have answered? Feel free to shoot me an e-mail at contact@etffocus.com or leave a comment wherever you happen to read one of my articles!

Today's question (lightly edited for clarity)...

Question: What do you think of QQQ and SPHD?

Answer: I'm assuming that when you ask this question, you mean how do the two funds fit together.

As a refresher, the PowerShares QQQ Trust ETF (QQQ) is a tech-heavy portfolio that is based on the Nasdaq 100 index. The PowerShares S&P 500 High Dividend Low Volatility ETF (SPHD) is loaded up primarily with large-caps that pay above average dividends and have historically displayed below average volatility. On the surface, these two funds would seem fairly dissimilar but let's take a deeper dive.

Before we take a look at the portfolio, let's take a look at the funds' risk and correlation.

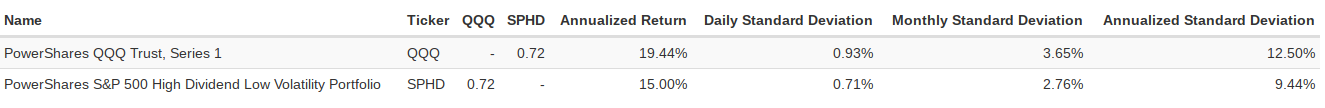

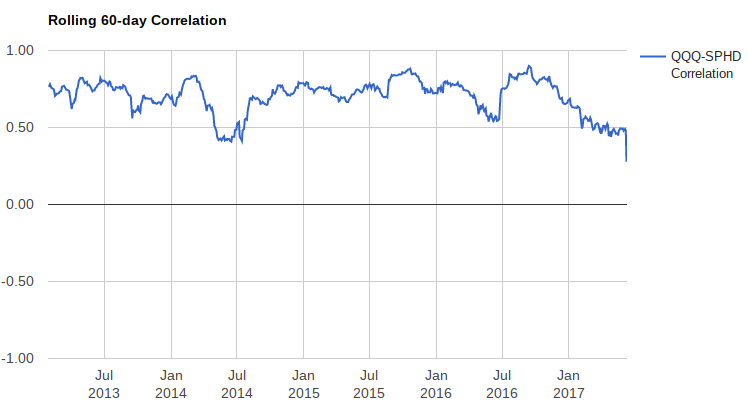

The correlation factor between the two funds is 0.72 which is a pretty low correlation for two large-cap funds. That's a good thing. Historically, the chart shows the two funds have been around that 0.75 area for most of the past four years. Correlation has dropped quite a bit recently as techs have easily been the market's top performing sector and large-cap value stocks have fallen behind.

Predictably, the low volatility ETF has demonstrated, well, low volatility. The long-term standard deviation of returns shows that SPHD has been about 25% less risky than QQQ. That's also a good thing because you generally want your portfolio to be able to balance out risks.

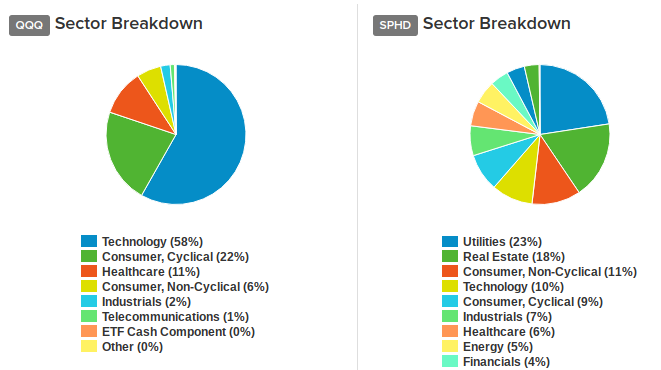

The portfolios also look pretty different. A look at the top 15 holdings in each fund show no overlap while the sector allocations are almost nothing alike.

QQQ is almost 90% tech and consumer stocks. SPHD has over 40% in utilities and real estate, two sectors which don't even appear in QQQ. The difference in composition of these two funds is, again, a good thing. QQQ has done great while techs have outperformed and would help carry the relative underperformance of SPHD in a two-fund portfolio. The opposite would be a reasonable assumption to make should techs begin lagging again.

The diversification benefits of pairing these two funds would be high. Having two funds in your portfolio that are significantly different is better than having 10 different funds that all look the same.

Overall, QQQ and SPHD would be a great fit together.

If you enjoyed reading this article, please be sure to share it below and subscribe to the site so that you don't miss any updates or new stuff! As always, thank you for taking the time to read!