Welcome to the final month of 2017, a year that has been great across almost all asset classes, sectors and markets. Traditionally, things calm down in December as investors focus more on the holidays and vacation time instead of their portfolios. Don’t let that distract you, though, from the fact that December is one of the best years to be in the equity markets.

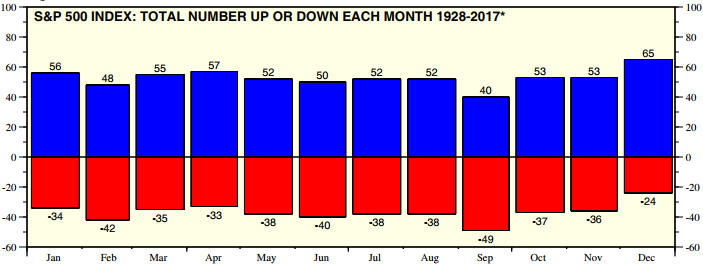

Consider this chart from economist Ed Yardeni.

The month of December has produced gains roughly 73% of the time, making it easily the best performing month. Is there any good reason why December tends to do the best? Not really. Market watchers tend to point to the so-called Santa Claus Rally, the time frame between Christmas and the first couple trading days of the new year where the markets also seem to go up. The reasons for this could be anything from year-end tax planning, bonuses or just plain feeling good about the holidays.

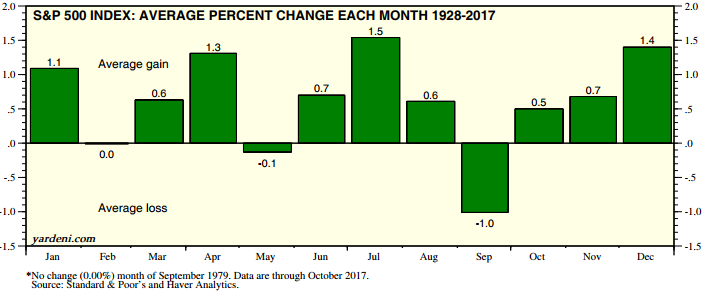

December’s average gain of 1.4% over the past nine decades makes it the second best month to be in the stock market (historically speaking, of course). That’s obviously no guarantee of what might happen in 2017, but the market’s current momentum backed up by a little history suggests that this year could end on a high note!

With that being said, here are your four ETFs to keep an eye on as we head into 2017’s home stretch.

ARK Innovation ETF (ARKK)

The Innovation ETF has consistently been one of 2017’s top performers, posting gains of more than 84% on the year. The fund’s theme of targeting technological improvement and innovative disruption has proven so popular this year that assets have grown from around $50 million at the beginning of the year to more than $200 million today. What’s fueled the big gains? A big stake in the Bitcoin Investment Trust (GBTC) for one, which is up nearly 800% year-to-date. Other winners include Juno Therapeutics (JUNO), Illumina (ILMN), Amazon (AMZN) and Tesla (TSLA). What does the remainder of the year have in store? Could be more gains as tech and momentum remain in firm control.

Others: ARK Web x.0 ETF (ARKW), ARK Industrial Revolution ETF (ARKQ)

WisdomTree Emerging Markets High Dividend ETF (DEM)

The emerging markets group has been one of this year’s top performers with the iShares Core MSCI Emerging Markets ETF (IEMG) racking up gains of roughly 36% this year. The good times haven’t been enjoyed across though as large-cap high dividend payers have lagged with gains of just 21%. This area looks particularly attractive heading into 2018 with a dividend yield of nearly 4% and a P/E ratio of just a little over 10. There aren’t many pockets of real value in the equity markets, but this might be one of them.

Others: WisdomTree Emerging Markets Dividend ETF (DVEM), WisdomTree Emerging Markets Small Cap Dividend ETF (DGS), SPDR S&P Emerging Markets Dividend ETF (EDIV)

Global X Social Media ETF (SOCL)

The Social Media ETF has really benefited this year from its overseas holdings. Two of the fund’s top positions, Tencent Holdings (TCEHY) and Yandex (YNDX), are up more than 100%, with two others, United Internet (UDIRF) and Nexon (NEXOF), up well over 50%. But with the fund trading at over 60 times earnings and 5 times book value, valuations are looking really expensive here.

iShares U.S. Home Construction ETF (ITB)

The homebuilders have also been big winners this year, as a combination of strong housing starts, low interest rates and rebuilding from several hurricanes have kept demand robust and steady. Any potential tax bill out of Washington looks like it’ll have little effect on the sector, but the potential for rising rates could dampen some of that demand into next year.

Others: SPDR S&P Homebuilders ETF (XHB), PowerShares Dynamic Building & Construction ETF (PKB)

Want to get the weekly ETF watchlist in your inbox every week? Simply subscribe to the site either below or at the right and you'll get it automatically along with our ETF Focus Weekly newsletter!