That's what at least one market watcher thinks.

A surprise drone strike on Saudi Arabian oil fields that figure to take half of the country's oil production offline could send oil prices soaring in the coming days. It's estimated that nearly 5.7 million barrels of oil a day or about 5% of the country's production could be shut down indefinitely. While Saudi Arabia will no doubt work feverishly to get these oil fields back online, there's no timeframe as to when that might be.

Saudi Arabia figures to use some of its oil reserves to keep available supplies in line with expectations but oil prices will take a hit. Early estimates say oil prices could rise $5 to $10 a barrel when the futures market opens.

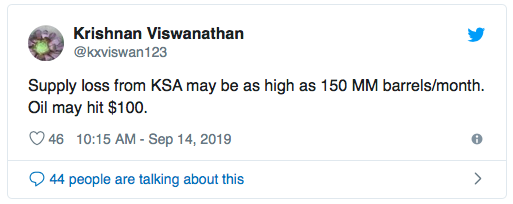

One analyst, however, points to a more dire scenario. If these oil fields remain offline for a while, that translates to 150 million barrels of oil a month.

This obviously wouldn't happen immediately and would be predicated on additional strikes on the region, something that the Houthi rebels, the group that has taken credit for the attacks, have promised. If this comes to pass, significantly higher oil prices are in the cards but $100 oil is still way off. Depending on the severity and length of the situation, $70 as a short-term price target seems more realistic.

Where do you think oil prices are headed? Comment down below!