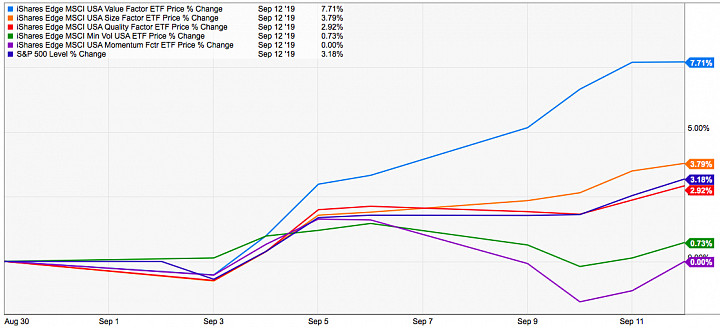

For the first time since the fourth quarter correction of last year, value stocks are taking market leadership. That instance was more that value stocks lost less than growth stocks. Right now, value stocks are leading on the way up.

During the month of September, the iShares Edge MSCI USA Value Factor ETF (VLUE) is up 7.7% compared to a 3.2% return for the S&P 500 (SPY).

Momentum, which has been the overwhelming market leader over the past several years, has fallen to last place.

Is value investing back? My gut says no. There are just too many forces in place that are driving to push the market higher from here (most of them political). With the Fed looking to cut rates multiple times over the next year and a trade war that can be used to drive the narrative, things are set up for more growth segment outperformance. Of course, all bets are off the table if the U.S. slips closer to recession sooner than anticipated. I don't think a recession is imminent at this point which should push the S&P 500 to new all-time highs.

But value's significant outperformance should act as a reminder that value investing is never dead.