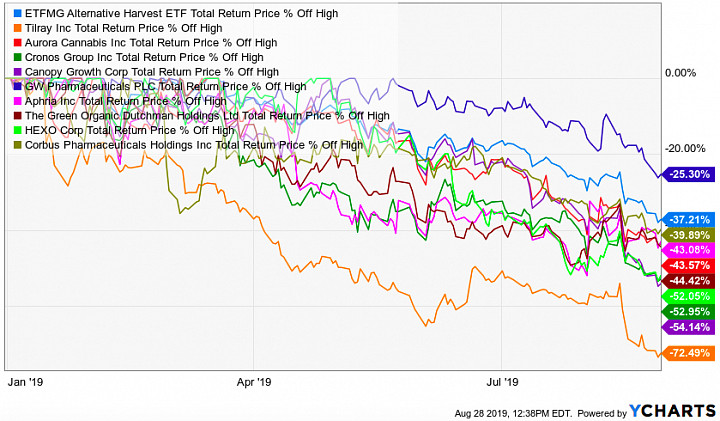

The charts over the past couple of months have been ugly. The Marijuana ETF (MJ) is down more than 37% from its 2019 high and individual names within the sector are doing much worse.

Tilray, perhaps the poster child for the industry, is down well over 70% from just the beginning of the year. Virtually every other one of the fund's top 10 holdings is down at least 40%. Yes, investors got way too ahead of themselves in bidding these stocks up to ridiculous levels but is it time to finally begin dipping your toes back in the water?

From a technical standpoint, the group looks way oversold. MJ is back down to December lows after experiencing a similar downtrend in Q4 of last year that cut the share price nearly in half.

From the fundamental side, there are still hurdles. Tilray recently indicated that average sale prices were below expectations in the 2nd quarter. While it's certainly negative press, I view this more as a simple supply/demand imbalance that will begin working itself out over time. The economic backdrop certainly isn't helping either as some market watchers have been suggesting that pot purchases might be one of the things to go first if consumers need to tighten the budget drawstrings.

I'm still a big believer in the marijuana industry long-term and feel that recent volatility and news is part of the deal when it comes to investing early in an industry. The cybersecurity space experienced a similar boom/bust cycle four years ago. The Cybersecurity ETF (HACK) jumped from $25 to $33 in just a few months before falling all the way back down to $19 in early 2016. It's only gone on to double in value since then.

If you're a bit of a risk-taker, I'd recommend adding a few shares here or putting in a few limit orders. This may or may not be the bottom but I think it's also a better relative value now than it has been at any point in the past. A lot of excess is being worked out right now which should make for a healthier long-term investment.

I still recommend holding the entire basket if you're going to invest in weed stocks. Given all the volatility and the fact that we're still very early in marijuana's life cycle, there's no sense in trying to pick individual winners. Own the fund and play the broader trend instead.

What do you think? Are you buying weed stocks right now? Comment down below!