The markets reminded us on Wednesday how even the calmest markets can turn volatile quickly. Investors started dumping risky assets en masse as events in Washington took a more serious turn. The VIX, which had been hovering around the 10 level quickly shot up to around 16 as the Dow dropped over 370 points and the Nasdaq shedding almost 160, their worst single day performances this year.

The low volatility ETF group, however, hung tough. These are the funds that target traditionally conservative stock and often are loaded up on sectors such as utilities and consumer goods. They're designed to provide a degree of safety in volatile markets and often kick off an above average dividend to boot.

Low volatility ETFs have been a bit of a mixed bag in 2017, but they did exactly what they were supposed to do during Wednesday's plunge.

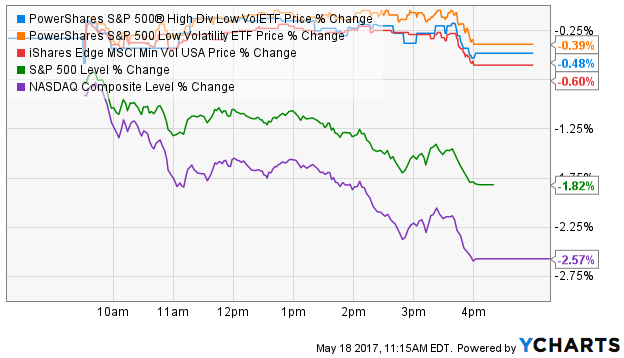

Three of the largest low volatility ETFs - the PowerShares S&P 500 High Dividend Low Volatility ETF (SPHD), the PowerShares S&P 500 Low Volatility ETF (SPLV) and the iShares Edge MSCI Minimum Volatility USA ETF (USMV) - all dropped around 0.5%, much less than the 2%-ish drop of the broader market.

Low volatility ETFs won't save investors like this every time the market experiences a sudden drop, but it is a reminder of the benefits of overall portfolio risk management.

If you enjoyed reading this article, please be sure to share it below and subscribe to the site so that you don't miss any updates or new stuff! As always, thank you for taking the time to read!