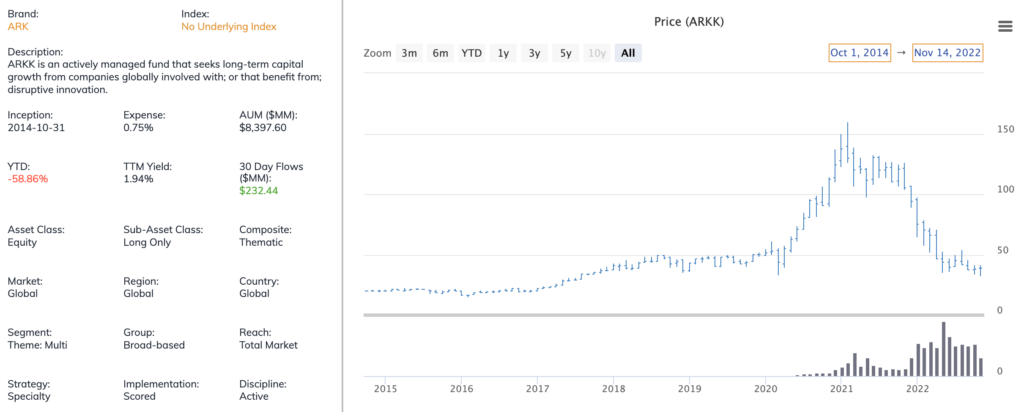

Up until around two years ago, the ARK Innovation ETF (ARKK) was one of the most popular and most successful ETFs in existence. Launched in late 2014, the fund flew mostly under the radar and didn’t do much of anything by the end of 2016. Performance since inception up to the point was essentially 0% and it had only about $12 million in assets.

2017, however, was the turning point. The disruptive innovation style that Cathie Wood has become known for was firmly in favor and ARKK had posted a calendar year gain of 87%. Investors also took notice and ballooned the fund’s assets up to $400 million.

By the end of 2019, ARKK was up to $1.9 billion in assets. Cathie Wood was becoming a household, boosted by her bold and headline-grabbing predictions about the stock price of Tesla, her largest holding at the time. Back in 2018, she said that Tesla was headed to $4,000 (pre-split), which would translate to a market cap of $672 billion, according to the article. At the time, the article also notes that the highest price target on the street was about $500.

The rest, of course, is history. Tesla’s stock price rocketed higher and its market cap eclipsed the $1.2 trillion mark at its peak at the end of 2021. Cathie Wood had become a stock market legend!

At its peak, ARKK was up about 740% since inception. Investors went return chasing and the fund blew up to about $28 billion in assets by early 2021. But that was the peak for ARKK and it’s been all downhill ever since. The initial post-pandemic boom, fueled by zero interest rates, trillions of dollars of government stimulus and all the liquidity you could ever want, was very good for all the ARK ETFs. The rocket ship higher, however, was unsustainable. What goes up must come down.

The disruptive innovation theme reversed and fell deeply out of favor. Within just three months of its peak, ARKK was down 30%. Within a year of it, the fund was down more than 60%. From peak to valley, ARKK fell more than 75% from its all-time high. Assets under management went from $28 billion to about $7.5 billion today. All in less than two years.

Is It Time To Take Another Look At ARKK?

Cathie Wood is certainly a polarizing figure in the financial markets and many investors that have gotten burned investing in the ARK ETFs are unlikely to ever return. Is that a mistake? The disruptive innovation theme is just like any other in the financial markets. It goes in and out of favor. Due to the unprofitable and speculative nature of the companies she tends to invest in, those highs are higher and those lows are lower. The highest high occurred in February 2021, but the lowest low is happening right now.

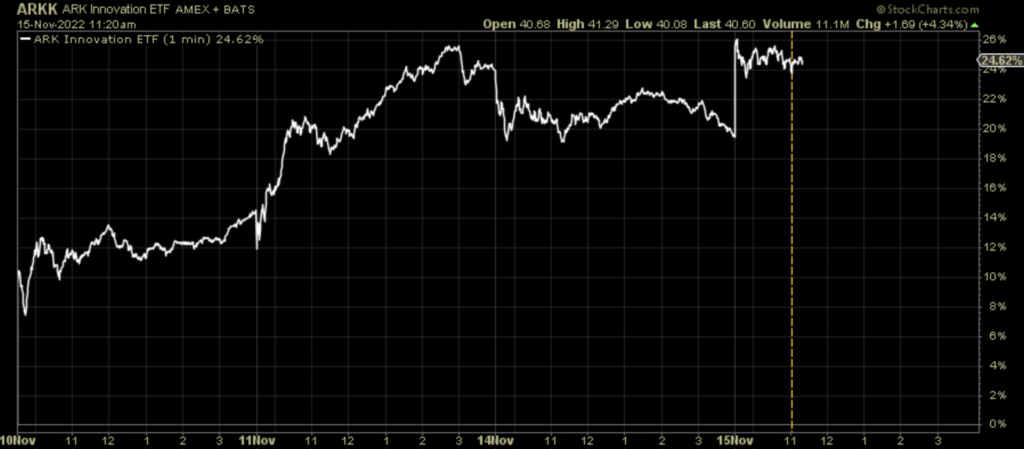

Last week’s lower than expected inflation reading could mark a turning point. Investors have been waiting for inflation to peak for months so the Fed can finally back off of its rate hiking cycle. The markets certainly reacted as if this was finally going to happen based on the furious rallies in stocks, bonds and gold.

ARKK did even better! It’s up more than 24% since Thursday as I write this.

The returns are attractive, but the question is whether or not they’re sustainable. To answer that, we need to look at the macroeconomic backdrop, including the potential path of the Fed, the likelihood of recession, where inflation is headed and any possible geopolitical risks in places, such as Ukraine, China and Russia.

Inflation Will Continue Falling, But Slowly

Sure, this was a positive step in the battle to get inflation back down to earth, but there’s a long way yet to go. The headline rate of 7.7% is the lowest its been since January, but the core rate of 6.3% still isn’t far off from its 2022 highs. Goods inflation is on the decline thanks to things, such as falling car prices and home goods, but services inflation is still rising. That’s being fueled primarily by rising shelter costs and services inflation is the type of inflation that’s sticky and won’t slow down quickly.

I think we’ll see inflation continue to slow, but a 4-5% rate by the end of 2023 is still the most likely outcome, not the 2-3% level that some are expecting. Month-over-month price increases are still at 0.4% and that means higher inflation for longer.

Slower inflation is good for ARKK, but it won’t be a “rocket ship” catalyst.

The Fed Won’t Stop Until Early 2023

The pace of rate increases is likely to slow. 75 basis point increases are probably a thing of the past, but we’ve still got another 100 basis points of rate increases still a part of the base case scenario. At this point, we’re probably looking at 50 in December, another 25 or 50 in February and then a final quarter-point move in March.

Some people are expecting a fairly quick pivot to rate cuts after that, but I’m just not seeing it. I think it’s possible we get the first quarter-point cut in the 4th quarter of 2023, but not before then. If inflation is still tracking at around 5-7% by the middle of the coming year, it doesn’t seem like the clear and decisive evidence that the Fed has been talking about.

The markets have consistently reacted positively to any hint of a Fed pause or pivot. We saw it last week and we’re likely to see it again. This could probably be the biggest catalyst for an extended short-term rally as rate hikes reach a conclusion.

The Economy Is Trending Towards Recession, But Maybe Not For Another 12 Months

The markets believe a recession in the United States and globally is a foregone conclusion. The question is when. Several months ago, it looked like it would happen around the end of this year. Now, it’s looking more like the 2nd half of 2022 or even beyond that. Growth has managed to remain in modestly positive territory and the labor market is still tight. Until those two factors change, I don’t think recession will be upon us.

That leaves a modest window open from after the Fed pivot (or pause) to before an actual recession where risk asset prices can run. I think conditions are looking favorable through the end of 2022 and probably into the first part of 2023. That’s where ARKK has its best opportunity for big gains.

Once the recession narrative starts kicking in, it’s time to exit again.

Conclusion

In the short-term, things look favorable for a new ARKK rally. In the longer-term, not so much.

Investors, I think, have an opportunity to capture outsized returns, but maybe only for the next 2-3 months. After that, I think conditions turn south and ARKK falls out of favor again.