Cyclicals have taken over the lead from defensive stock over the past two weeks. The tech and consumer discretionary sectors are up more than 5% during that time while the core defensive sectors - real estate, consumer staples, utilities and healthcare - have lagged badly. The rally is mostly trade-fueled which means these gains are tenuous at best. Watch for trade rhetoric to drive the market narrative more than earnings, GDP or any other economic data.

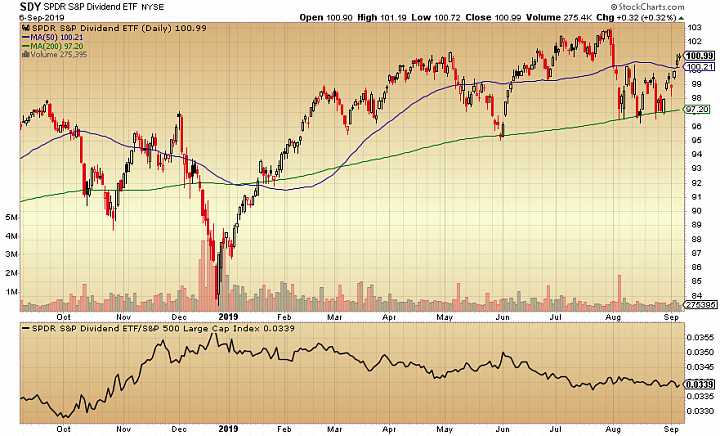

SPDR S&P Dividend ETF (SDY) - Broadly speaking, dividend payers have lagged the S&P 500 for most of 2019 (although the dividend aristocrats have done fairly well. The last month has been telling. When defensive stocks led the market, SDY lagged. When cyclicals took over during the past two weeks, SDY lagged again. Right now, investors are either risk-on or risk-off and dividend equities are getting left behind.

Van Eck Vectors Junior Gold Miners ETF (GDXJ) - The rally in gold and silver looks to have hit a short-term peak and topped out short of $43 twice in the past month. Most investors are crowding into gold but this rally looks overdone. Trump has a vested interest in keeping the stock market inflated heading into 2020 and my guess is he'll succeed through interest rate policy, trade negotiations or some other method. That would suggest a bearish environment for gold.

iShares 20+ Year Treasury Bond ETF (TLT) - The 10-year Treasury yield saw its biggest single day spike in nearly two years last week. We've seen the positive/negative back and forth sentiment of China trade negotiations many times but this should act as a warning that when a trade agreement is reached, likely before next year's election, bond yields could surge sending Treasury prices crashing. We're not at that point yet but this rally is definitely overdone.