If you're a trader that likes to dabble in leveraged and inverse ETFs, this week was no doubt a fun one for you. We saw the debut of five new triple-levered funds (with a bit of a Trump-ian flair) from leveraged fund specialist Direxion. I want to discuss those funds briefly before jumping into the more notable new entries into the space, the quadruple-leveraged funds from ForceShares.

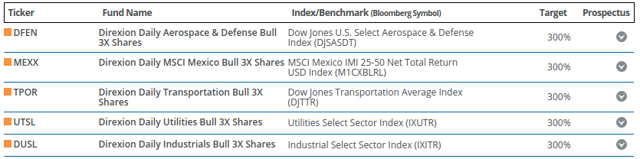

Of Direxion new ETFs, three fit with the provider's sector-themed approach.

The transportation (TPOR), utilities (UTSL) and industrials (DUSL) triple bull funds are pretty straightforward additions to their existing lineup that already includes ETFs focused on healthcare, financials, real estate, technology, etc. I'd imagine that in the not-so-distant future, we'll see triple bear versions of these sector funds as well.

The other two are a little more intriguing.

Click the button below to read the rest of this original article on Seeking Alpha.

If you enjoyed reading this article, please be sure to share it below and subscribe to the site so that you don't miss any updates or new stuff! As always, thank you for taking the time to read!