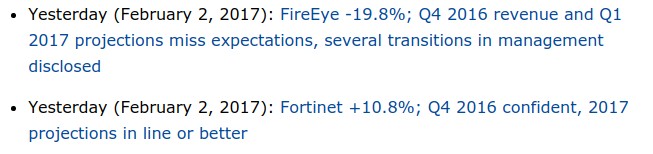

As I was perusing this morning’s market news, I came across these two headlines positioned side by side.

It certainly sounds like a tale of two cities if ever there was one. Fortinet (FTNT) beat Q4 estimates on both the top and bottom lines, raised 2017 guidance and saw both margins and free cash flow grow.

FireEye (FEYE), on the other hand, delivered results that were almost the complete opposite. Revenues missed expectations in Q4 and have now fallen to essentially flat year over year. Billings are down, margins are shrinking and the company guided significantly lower for 2017. On top of that, Mike Berry, FireEye’s chief financial officer, and Dave Dewalt, the former CEO and executive chairman of the board, both resigned from the company.

So which company’s quarterly report is more representative of the cybersecurity sector as a whole?

Right now, the sector as a whole has more good going for it than bad. I wrote a couple of weeks ago how Check Point Software’s (CHKP) big quarter could be a good sign for the whole group and called for a short term 5% gain in the two cybersecurity ETFs - the PureFunds ISE Cybersecurity ETF (HACK) and the First Trust NASDAQ Cybersecurity ETF (CIBR). Both are up more than 3% since that article was published.

Along with Check Point and Fortinet, Proofpoint (PFPT) also recently topped its earnings estimates with big names such as Palo Alto Networks (PANW) and CyberArk Software (CYBR) set to report later this month.

My recommendation is still to stick with one of the cybersecurity ETFs to get broad exposure to the sector instead of trying to pick individual names. While the sector is doing broadly well overall, the results of FireEye show that there are still winners and losers within the space.

Unfortunately, I was way wrong in my enthusiasm for FireEye a couple of years ago. I had a relatively modest position of about 700 shares at the time. I touted FireEye as one of my top picks in the space thanks to, at the time, growing revenues and cash flows along with synergies I thought the company would enjoy due to the Mandiant acquisition. The story played out for a little while but FireEye looks like little more than an acquisition target now.

The bull thesis for cybersecurity stocks should remain intact. Although it’s one of the few things Donald Trump hasn’t signed an executive order for, he has pledged additional resources to beef up the nation’s cybersecurity initiatives. That would be on top of the Obama pledge to commit $19 billion of Federal resources to combat cybersecurity threats.

Given the sector’s 30% rise over the past year, now might not be the best entry point for investors but, over the long term, cybersecurity still looks like a solid bet.

If you enjoyed reading this article, please be sure to share it below and subscribe to the site so that you don't miss any updates or new stuff! As always, thank you for taking the time to read!