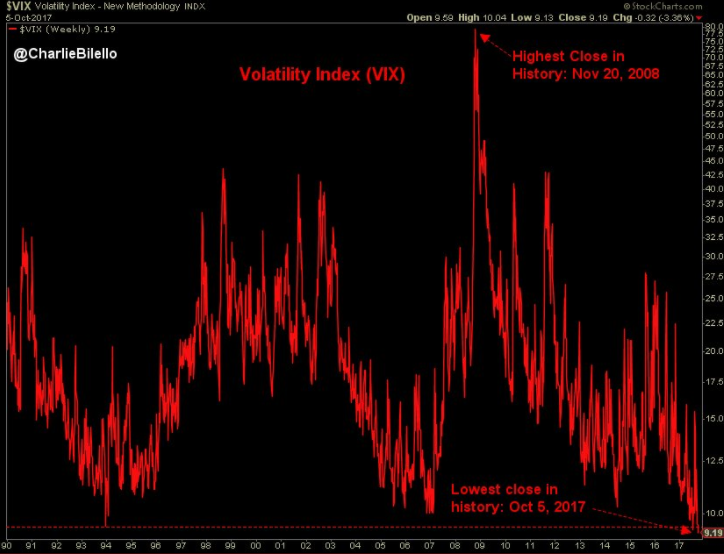

If you’ve flipped on the financial news at any point over the last few months, you’ve probably heard somebody talking about market volatility. Or, specifically, the lack of it. Take a look at this chart for the CBOE Volatility Index (VIX) over the last 25 years or so.

The VIX finished at 9.19 on Thursday, which is the lowest close in history. As in EVER! Here’s another stat for you. The VIX has closed below 10 on a total of just 23 trading days since 1990. All but three of them have taken place in 2017. We are living in a period of market calm that is literally without precedent.

A sound economy and a Fed policy that’s put a lot of wind into the market’s sails have continued to push equities higher, but why the lack of volatility? One theory blames ETFs and the overwhelming migration to passively managed index funds. It theorizes that a constant heavy flow of money going into unmanaged ETFs is dulling some of the volatility that typically comes when money managers trade more actively.

Are investors discounting volatility right now? According to Charlie Bilello, the annualized volatility of the S&P 500 over the past year is about the same as you’d typically find in a total bond market fund. That’s atypical though and investors shouldn’t get comfortable with the idea that the stock market lacks risk. As Bilello says in his article, “the absence of risk does not mean the elimination of risk”.

With that in mind, here are the four ETFs to watch in the coming week.

iShares Micro Cap ETF (IWC)

I wrote about the current state of micro-cap stocks earlier this week. In short, it’s been remarkable. The Micro Cap ETF put together a run where it was up on 29 out of 31 trading days before it ended this past week. As of August 18th, the fund was down 1.8% on the year. As of Friday, it’s now up 13%. After such a run up, this probably isn’t the best entry point, but the micro cap segment of the market still does demonstrate some value.

Others: First Trust Dow Jones Select MicroCap Index ETF (FDM)

VanEck Vectors Emerging Markets High Yield Bond ETF (HYEM)

Junk bonds and emerging markets are probably sufficiently risky on their own. So putting them together sounds like a double dose of dangerous, but there’s some opportunity here. Credit spreads on these bonds have shrunk considerably as financial positions strengthen and companies no longer have to offer exorbitant yields in order to attract investors. This ETF is up nearly 9% on the year, and currently pays a 5.8% yield.

Others: iShares JP Morgan USD Emerging Markets Bond ETF (EMB), iShares Emerging Markets High Yield Bond ETF (EMHY)

Rex VolMAXX Inverse VIX Weekly Futures Strategy ETF (VMIN)

In keeping with this week’s volatility theme, it shouldn’t come as a surprise that the year’s top performing ETF benefits from low volatility. The fund holds futures contracts to establish a short position in the VIX. The lower the volatility, the better the fund performs. It’s up 134% on the year. Shorting volatility has been a popular, and profitable, strategy in 2017. The two biggest inverse volatility funds - the VelocityShares Daily Inverse VIX Short Term ETN (XIV) and the ProShares Short VIX Short Term Futures Fund (SVXY) - have both gained more than 100% on the year and manage a combined $2 billion in assets.

Others: VelocityShares Daily Inverse VIX Short Term ETN, ProShares Short VIX Short Term Futures Fund

First Trust Nasdaq Global Auto Index ETF (CARZ)

Tesla made news this week when it announced disappointing production numbers for its Model 3. While that nugget made the most headlines, it’s news from the traditional automakers, such as Ford (F) and General Motors (GM), that deserves attention. Both companies posted solid sales numbers in September, and are starting to be viewed as autonomous vehicle plays themselves. Ford and GM account for 17% of this ETF’s portfolio, which is up 23% this year.

Want to get the weekly ETF watchlist in your inbox every week? Simply subscribe to the site either below or at the right and you'll get it automatically along with our ETF Focus Weekly newsletter!